tax credit community meaning

The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to. Browse reviews directions phone numbers and more info on Tax Credits LLC.

/128092498-589d45465f9b58819cd13912.jpg)

Tax Credit Property Definition

A tax credit differs from deductions and exemptions which reduce taxable.

. From 2003 through 2020. A tax credit property is an apartment complex or housing project owned by a landlord who participates in the federal low-income housing tax credit LIHTC program. Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants.

The New Markets Tax Credit NMTC was established in 2000. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854. A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar.

Noun an amount of money that is subtracted from taxes owed. Narcise CPA is the partner in charge of the Real Estate Construction Services Group specializing in all areas of accounting audit and tax for family. The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property.

The Low-Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low- and moderate-income tenants. What Is a Tax Credit. The credit can be in the form of a rebate or a direct reduction of the amount.

Community Tuition Grant Organization. The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property. Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to provide.

To provide low-income families with tuition assistance and to offset the cost of tuition for parents who would like the option of sending their child to. Another office of the organization is located at 45 Knightsbridge Rd Piscataway NJ. Community Credit Counseling Corp.

The NMTC Program incentivizes community development and economic growth through the use of tax credits that attract private investment to distressed communities. A tax credit is an incentive provided to the taxpayers by the government effectively reducing the total tax paid. Basically tax and credit community offers account management tax accounting training business clients business and personal credit and LLC and incorporation set-up to provide.

1-888-TAXES-11 free tax preparation assistance NJ Citizen Action Central Jersey 85 Raritan Ave Suite 100 Highland Park NJ 08904 732-246-4772. A registered office address of Tax Credits is 242 Old New Brunswick SUITE 145 Piscataway NJ 08854. A tax credit property is an apartment complex or housing project owned by a develoThese developers and landlords can claim tax credits for eligible buildings in retA tax credit property is an apartment complex or housing project owned by a landlorLandlords can claim tax credits for eligible buildings through the LIHTC.

%20(1)-page-002.jpg?width=720&watermark=&hash=klaf2w5hY6T9FeuLAJmsCHWZ3g8v7VA2345F1F-PDzM)

Baltimorejewishlife Com Time To Submit Homeowners Renters Tax Credit Applications Has Been Extended

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Senate Moves Forward With Ev Tax Credit Reform Tesla Tsla To Be Included Back And More Electrek

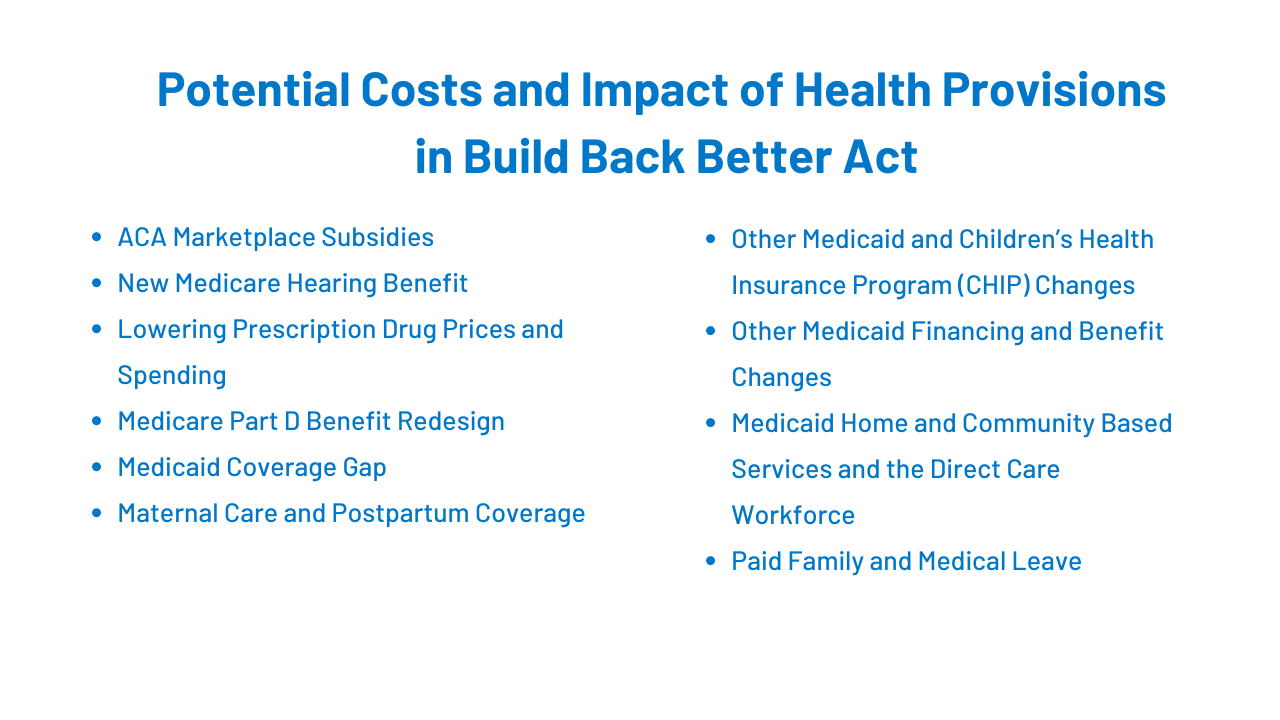

Potential Costs And Impact Of Health Provisions In The Build Back Better Act Kff

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Low Income Housing Tax Credit Costly Complex And Corruption Prone Cato Institute

Low Income Housing Tax Credit Lihtc Tax Foundation

Low Income Housing Tax Credit Lihtc Tax Foundation

Tax Incentives Technical Preservation Services National Park Service

R D Tax Credit Calculation Methods Adp

Dupaco Community Credit Union Whether You Ve Been Meaning To Drop Off Clothes At Goodwill Or Donate To Your Favorite Charity Now S Your Chance To Make Those Good Intentions Count For Your

What Is The New Markets Tax Credit And How Does It Work Tax Policy Center

Exploring The Potential Of Tax Credits For Funding Population Health National Academy Of Medicine

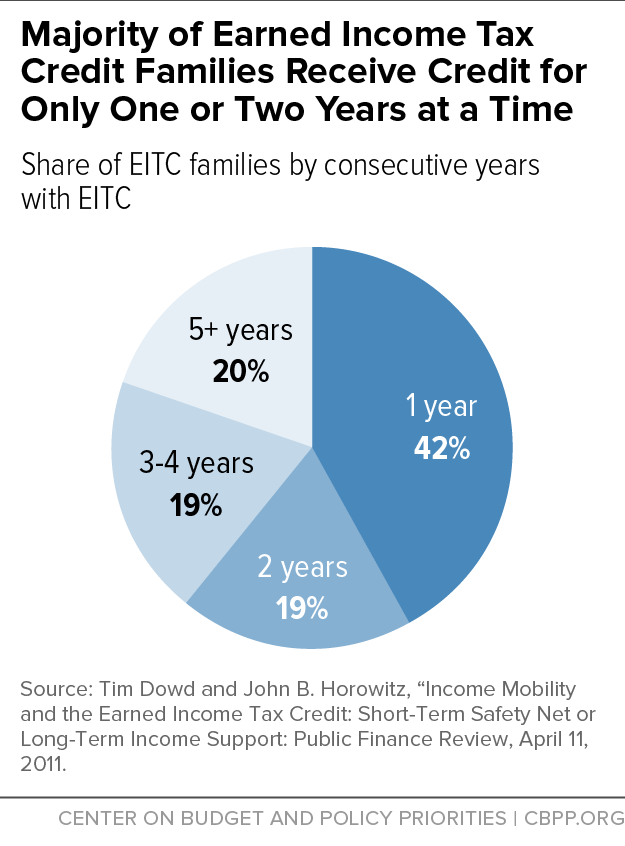

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

Policy Basics The Earned Income Tax Credit Center On Budget And Policy Priorities

Deducting Property Taxes H R Block

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos